Global markets reeled on Monday as energy prices spiked following joint US-Israeli strikes on Iran’s nuclear sites, fuelling concerns of retaliation that could choke one of the world’s most critical oil routes.

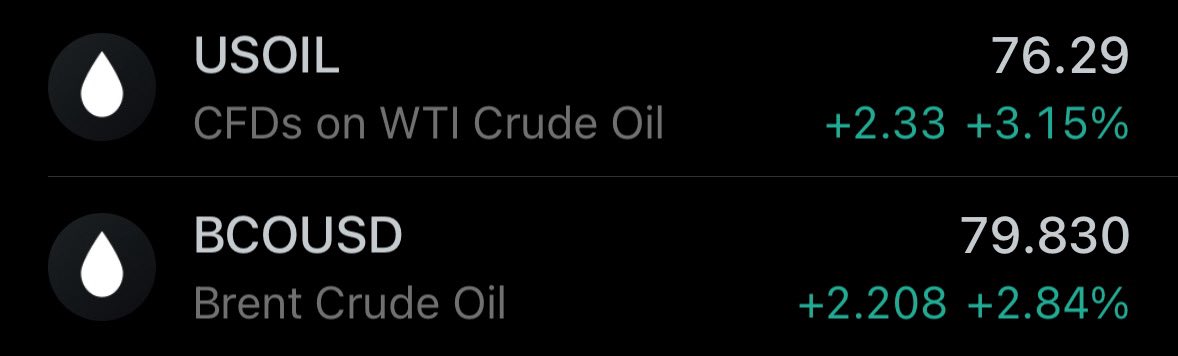

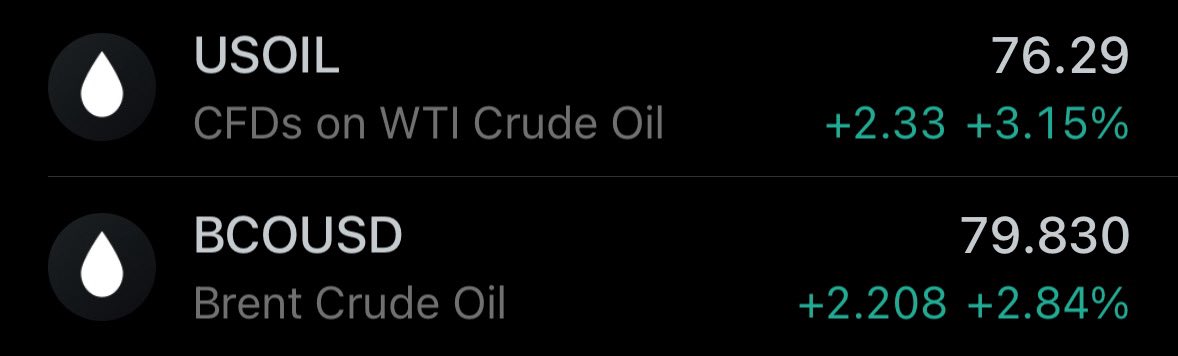

Brent crude rose 2.7 per cent to $79.12 a barrel, while US crude jumped 2.8 per cent to $75.98—both reaching levels unseen since January. Fears centre around Tehran’s potential move to close the Strait of Hormuz, a maritime bottleneck that channels a quarter of global oil trade and 20 per cent of liquefied natural gas (LNG) exports.

Asian indices plunge, Europe shaky

Markets across Asia sank. Tokyo’s Nikkei fell 0.6 per cent, Seoul dropped 1.4 per cent, and Sydney lost 0.7 per cent. MSCI’s Asia-Pacific index (excluding Japan) slipped 0.5 per cent, while EUROSTOXX 50 futures dropped 0.7 per cent. The FTSE and DAX futures also registered similar losses.

Investors awaited signs of Iranian retaliation after Iran’s Press TV reported that the country’s parliament had approved a measure to shut the Strait in response to the US military action.

“Selective disruptions that scare off oil tankers make more sense than closing the Strait of Hormuz given Iran’s oil exports would be shut down too,” said Vivek Dhar, commodities analyst at the Commonwealth Bank of Australia, in a comment to Reuters.

“In a scenario where Iran selectively disrupts shipping through the Strait of Hormuz, we see Brent oil reaching at least $100/bbl,” he warned.

Also read: Iran shuts Strait of Hormuz

Gold, Treasuries unmoved, dollar firms

Unlike oil, gold prices remained largely flat, slipping 0.1 per cent to $3,363 an ounce. The dollar index firmed 0.17 per cent to 99.078. Against the yen, the dollar rose to 146.48, while the euro dipped 0.3 per cent to $1.1481.

There was no significant flight to Treasuries, with 10-year US yields rising by two basis points to 4.397 per cent, signalling a cautious but not panicked market.

JPMorgan warns of past pattern

In a note of caution, analysts at JPMorgan reminded investors that previous episodes of regime change or unrest in the Middle East have led to dramatic oil spikes, averaging 30 per cent with short-term surges of up to 76 per cent.

Optimists, meanwhile, are pinning hopes on Iran stepping back now that its nuclear capabilities have been targeted. Others speculate that internal political shifts could yield a less aggressive stance towards the West.

But for now, the tremors from the US strike and Iran’s potential retaliation have set the stage for continued volatility in global markets—especially in energy-dependent regions such as Europe and Japan.

Iran, the world’s ninth-largest oil producer with an output of 3.3 million barrels per day, exports roughly half of its production. Its domestic economy would also suffer if the Strait were completely shut—making the threat of partial or symbolic disruption more likely than a full closure.